Healthcare Payer Service Market Size, Share, Trends, Industry Analysis Report: By Service, Application, End Use (Private Payers and Public Payers), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3225

- Base Year: 2024

- Historical Data: 2020-2023

Healthcare Payer Service Market Overview

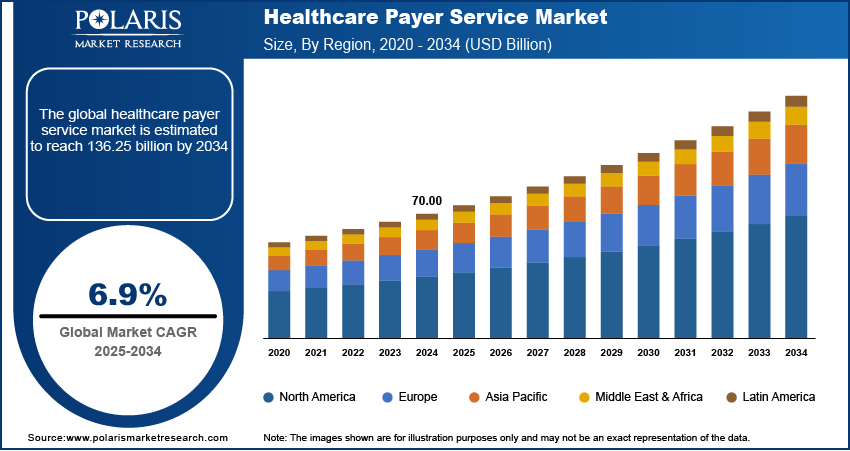

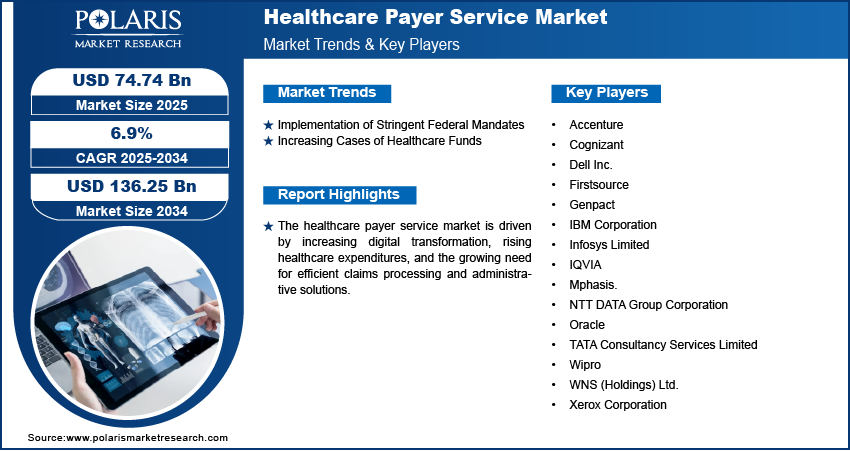

The global healthcare payer service market was valued at USD 70.00 billion in 2024. It is expected to grow from USD 74.74 billion in 2025 to USD 136.25 billion by 2034, at a CAGR of 6.9% during the forecast period.

Healthcare payer services include outsourced solutions that help health insurance companies, government agencies, and other payers manage claims, communicate with members, and handle administrative tasks efficiently. The market is growing because of increasing regulatory requirements and operational challenges. Strict government rules, such as data security laws and system updates, require payers to invest in technology and compliance. For instance, in January 2024, the CMS introduced a rule to improve healthcare information sharing and reduce paperwork for treatment approvals. Insurance companies must update their systems by early 2026 to make patient care access easier. These regulations have increased workloads for payers, leading them to seek expert services to handle compliance and operations effectively, boosting the growth of the healthcare payer services market.

To Understand More About this Research: Request a Free Sample Report

The rising cases of healthcare funds, suppoerted by government-sponsored schemes and private investments, have further influenced the healthcare payer service market. A December 2024 report by CMS indicated that US healthcare spending increased by 7.5 percent in 2023, totaling USD 4.9 trillion or USD 14,570 per person. Health spending represented 17.6 percent of the nation's Gross Domestic Product. The surge in funding has resulted in a higher volume of claims processing, fraud detection, anomaly detection, and payment integrity tasks, necessitating advanced solutions to streamline operations. Payer organizations must adapt to manage administrative complexities while ensuring cost efficiency as healthcare systems continue to expand with increased financial backing. Consequently, outsourcing payer services has emerged as a strategic approach to handle increasing financial transactions, regulatory compliance, and data-driven decision-making in a rapidly evolving healthcare landscape.

Healthcare Payer Service Market Dynamics

Implementation of Stringent Federal Mandates

Regulatory frameworks, such as data privacy laws, interoperability requirements, and value-based care models, require payers to enhance compliance mechanisms while managing complex administrative processes. For instance, in March 2024, the Centers for Medicare & Medicaid Services (CMS) launched the Change Healthcare/Optum Payment Disruption (CHOPD) program to help Part A providers and Part B suppliers affected by a cyberattack on change healthcare. The program allows eligible providers to request accelerated payments for up to 30 days’ worth of claims, which will be recouped over 90 days from future Medicare claims. These mandates impose strict reporting, auditing, and claims management requirements, leading to a surge in operational complexities. As a result, payer organizations seek external service providers to streamline compliance, optimize resource allocation, and ensure regulatory adherence. The growing burden of federal policies has, therefore, reinforced the need for efficient and scalable payer service solutions.

Increasing Cases of Healthcare Funds

The expansion of government-sponsored healthcare programs, private investments, and employer-funded insurance plans has led to a rise in claim submissions, fraud prevention measures, and reimbursement processes. For instance, in March 2024, UnitedHealth Group made progress in addressing the impacts of a major cyberattack on Change Healthcare that occurred in February 2024. The company advanced over USD 2 billion to assist affected providers and has begun restoring services, including medical claims preparation software. The influx of funds necessitates robust administrative support to prevent inefficiencies, ensure accurate payments, and maintain financial transparency. Payer service providers offer technology-driven solutions to handle these complexities, enabling insurers and healthcare organizations to enhance operational efficiency while managing the financial aspects of patient care.

Healthcare Payer Service Market Segment Analysis

Healthcare Payer Service Market Assessment by Service

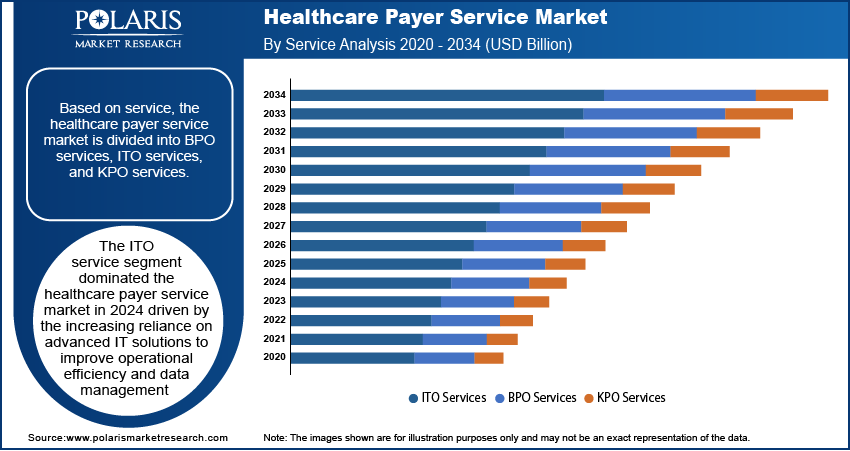

The global healthcare payer service market segmentation, based on service, includes BPO services, ITO services, and KPO services. The ITO services segment dominated the market in 2024 driven by the increasing reliance on advanced IT solutions to improve operational efficiency and data management. Payers are investing in cloud computing, cybersecurity, and AI-driven analytics to streamline claims processing, fraud detection, and regulatory compliance. The growing adoption of electronic health records (EHRs) and digital payment systems has further accelerated the demand for ITO services, enabling seamless data integration and interoperability. Additionally, the rising complexity of healthcare regulations and the need for scalable IT infrastructure have reinforced the dominance of ITO services in transforming payer operations and optimizing administrative workflows.

Healthcare Payer Service Market Evaluation by End Use

The global healthcare payer service market is segmented by end use into private payers and public payers. The public payers segment is expected to witness the highest healthcare payer service market growth during the forecast period due to increasing government initiatives aimed at expanding healthcare coverage and improving reimbursement models. Public healthcare programs are focusing on enhancing efficiency through digital transformation and outsourcing payer services with rising healthcare expenditures and an aging population. The demand for cost-effective solutions in claims management, member enrollment, and compliance tracking is driving public payers to adopt advanced healthcare payer services. Additionally, the integration of AI-driven analytics and automation in public health insurance programs is further accelerating market growth, enabling efficient service delivery and improved patient access to care.

Healthcare Payer Service Market Regional Insights

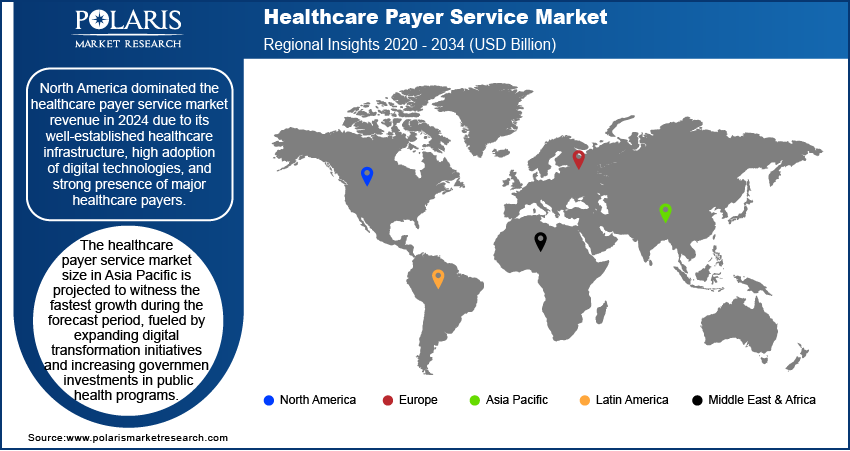

By region, the report provides the healthcare payer service market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to its well-established healthcare infrastructure, high adoption of digital technologies, and strong presence of major healthcare payers. For instance, in March 2024, the Centers for Medicare & Medicaid Services (CMS) announced its FY 2024 budget, focusing on advancing health equity and improving health outcomes for over 160 million Americans. Key initiatives include enhancing mental health services and implementing measures from the Affordable Care Act and the Inflation Reduction Act to lower healthcare costs and improve access to treatments. CMS aims to provide high-quality health benefits through innovation and technology. The region’s focus on optimizing administrative processes, improving patient engagement, and reducing operational costs has driven investments in payer services, particularly in IT outsourcing and business process management. Regulatory frameworks supporting value-based care and data security compliance have further propelled healthcare payer service market growth. Additionally, the increasing shift toward cloud-based payer solutions and AI-driven analytics has strengthened North America’s leadership in the market, ensuring efficient claims processing and enhanced healthcare delivery.

The healthcare payer service market in Asia Pacific is projected to witness the fastest growth during the forecast period, fueled by expanding digital transformation initiatives and increasing government investments in public health programs. For instance, in December 2024, the Ministry of Health urged states to raise their health budgets by 10% annually. The DoHFW budget increased to USD 101.1 million in 2024-25, while the 15th Finance Commission allocated USD 8.09 billion in health grants to local governments. This substantial investment demonstrates the growing emphasis on strengthening healthcare infrastructure and digital capabilities across regions, setting a benchmark for global healthcare payer service market development. Additionally, the growing penetration of private health insurance providers, coupled with the increasing focus on cost containment and operational efficiency, is further accelerating market expansion. Therefore, as healthcare systems in the region continue to evolve, the demand for advanced payer service solutions is expected to rise, positioning Asia Pacific as a key growth hub in the global market.

Healthcare Payer Service Key Market Players & Competitive Analysis Report

The competitive landscape combines global leaders and regional players competing to capture healthcare payer service market share through innovation, strategic alliances, and regional expansion. Global players such as UnitedHealth Group (Optum), Accenture, Cognizant, and others leverage robust technological capabilities and extensive service networks to deliver advanced claims processing, member engagement solutions, and data analytics tools. The market trends indicate rising demand for solutions such as AI-driven fraud detection and cloud-based platforms, including interoperability solutions, reflecting advancements in digital healthcare and administrative efficiency.

The market is projected to grow rapidly, driven by increasing healthcare costs, regulatory compliance requirements, and the need for operational optimization. Regional companies capitalize on localized needs by offering cost-effective and tailored services, especially in emerging markets such as Asia Pacific, which is anticipated to grow at the highest CAGR. The competitive strategies include mergers and acquisitions, partnerships with healthcare technology providers, and the introduction of innovative digital solutions to address the growing need for efficient claims processing and enhanced member experience. A few key major players are Accenture; Cognizant; Dell Inc.; Firstsource; Genpact; IBM Corporation; Infosys Limited; IQVIA; Mphasis; NTT DATA Group Corporation; Oracle; TATA Consultancy Services Limited; Wipro; WNS (Holdings) Ltd.; and Xerox Corporation.

IQVIA provides healthcare payer services and offers innovative solutions designed to enhance efficiency and improve patient outcomes. Their health insurance management platform integrates patients, providers, and payers, facilitating seamless communication and transaction processing while adhering to regulatory standards. This platform enables healthcare organizations to manage claims effectively and optimize the patient journey through real-time data analytics and operational support. Additionally, IQVIA's payer analytics solutions empower payers with actionable insights derived from extensive market data, enabling informed decision-making regarding formulary strategies and member engagement. IQVIA helps payers identify cost-saving opportunities and improve healthcare delivery by leveraging advanced analytics, ultimately driving better health outcomes and competitive differentiation in the evolving healthcare landscape. Through these services, the company plays a crucial role in transforming how healthcare payers operate, ensuring they remain agile and responsive to market demands.

Mphasis is a global IT solutions provider headquartered in Bengaluru, India, specializing in cloud and cognitive services. It offers tailored payer services that enhance operational efficiency and improve patient experiences within the healthcare sector. Their comprehensive solutions include claims processing, member management, and data analytics, enabling healthcare payers to streamline operations and adapt to regulatory changes effectively. Mphasis employs advanced technologies such as artificial intelligence and machine learning to deliver insights that drive decision-making and optimize healthcare delivery. The company’s Front2Back transformation approach emphasizes a customer-centric model, ensuring that healthcare payers can provide hyper-personalized services to their members. Mphasis is well-positioned to support healthcare organizations in navigating the complexities of the industry while enhancing service quality and operational performance with a strong focus on innovation and domain expertise.

Key Companies in Healthcare Payer Service Market

- Accenture

- Cognizant

- Dell Inc.

- Firstsource

- Genpact

- IBM Corporation

- Infosys Limited

- IQVIA

- Mphasis.

- NTT DATA Group Corporation

- Oracle

- TATA Consultancy Services Limited

- Wipro

- WNS (Holdings) Ltd.

- Xerox Corporation

Healthcare Payer Service Market Developments

September 2024: Talkdesk, Inc. launched the Talkdesk Healthcare Experience Cloud for Payers, a contact center solution tailored to the customer experience needs of healthcare insurance organizations.

June 2024: Cognizant launched healthcare large language model (LLM) solutions on Google Cloud's generative AI technology, including the Vertex AI platform and Gemini models, to improve administrative processes and user experiences.

Healthcare Payer Service Market Segmentation

By Service Outlook (Revenue, USD Billion, 2020 - 2034)

- BPO Services

- ITO Services

- KPO Services

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Claims Management Services

- Integrated Front Office Service and Back Office Operations

- Member Management Services

- Provider Management Services

- Billing and Accounts Management Services

- Analytics and Fraud Management Services

- HR Services

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Private Payers

- Public Payers

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Healthcare Payer Service Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 70.00 billion |

|

Market Size Value in 2025 |

USD 74.74 billion |

|

Revenue Forecast in 2034 |

USD 136.25 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global healthcare payer service market size was valued at USD 70.00 billion in 2024 and is projected to grow to USD 136.25 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

North America dominated the healthcare payer service market revenue in 2024.

Some of the key players in the market are Accenture; Cognizant; Dell Inc.; Firstsource; Genpact; IBM Corporation; Infosys Limited; IQVIA; Mphasis; NTT DATA Group Corporation; Oracle; TATA Consultancy Services Limited; Wipro; WNS (Holdings) Ltd.; and Xerox Corporation.

The ITO service segment dominated the healthcare payer service market in 2024.